Flood Insurance vs Regular Home Insurance: Understanding the Differences

2/8/2023 (Permalink)

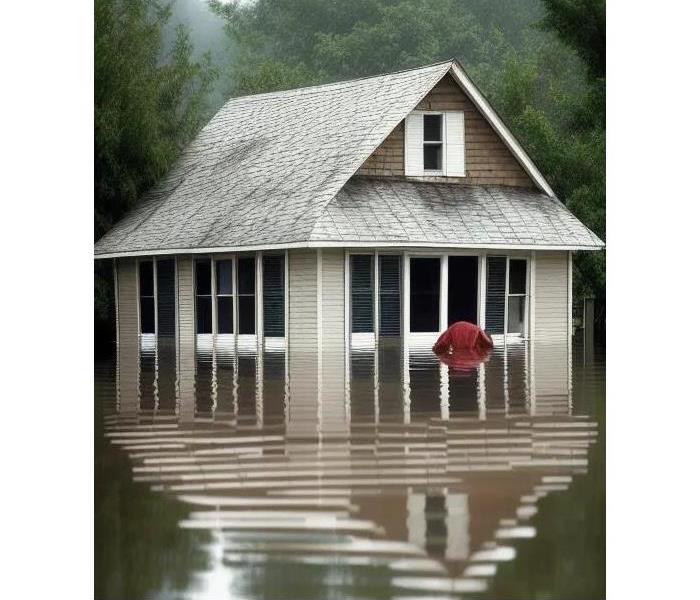

When it comes to protecting your home, having the right insurance coverage is essential. Whether you are looking to protect your home from fire, theft, or natural disasters, having the right insurance coverage can provide peace of mind and help you avoid costly expenses in the event of a loss. However, with so many different types of insurance coverage available, it can be difficult to know what type of insurance coverage is right for you. In this article, we will explore the differences between flood insurance and regular home insurance and the costs involved.

What is Flood Insurance?

Flood insurance is a type of insurance coverage that provides protection for homes and businesses against damage from flooding. This type of insurance is designed to protect against the financial losses that can occur from water damage, including damage to the structure of your home, its contents, and personal belongings.

What is Regular Home Insurance?

Regular home insurance, also known as homeowners insurance, is a type of insurance that provides protection for homes against damage from a variety of sources, including fire, theft, and natural disasters. This type of insurance coverage can include protection for the structure of your home, its contents, and personal belongings, as well as liability coverage for accidents that may occur on your property.

Costs Involved

The costs involved with both flood insurance and regular home insurance can vary widely depending on several factors, including the location of your home, its value, and the amount of coverage you need. Flood insurance typically costs more than regular home insurance, as the risk of damage from a flood is higher. However, the cost of flood insurance can vary greatly depending on the flood zone your home is in, with homes in higher risk areas costing more to insure. Regular home insurance, on the other hand, typically costs less, but again, the cost will depend on the value of your home, its location, and the amount of coverage you need.

Differences in Insurance Coverage

While both flood insurance and regular home insurance provide protection for your home and belongings, there are significant differences in the types of coverage they offer. Flood insurance typically provides more comprehensive protection against damage from flooding, including protection for the structure of your home, its contents, and personal belongings. Regular home insurance, on the other hand, may provide limited protection against damage from flooding, and may not cover damage from flooding at all, depending on the policy.

When it comes to protecting your home and personal belongings, having the right insurance coverage is essential. Whether you choose flood insurance or regular home insurance, it is important to understand the differences in coverage and costs involved so that you can make an informed decision. By considering your specific needs and the risks associated with your home, you can choose the insurance coverage that is right for you and your family.

24/7 Emergency Service

24/7 Emergency Service